Within today's competitive corporate landscape, grasping the nuances of value-added tax, or VAT, is vital for maintaining financial health and guaranteeing compliance. Due to varying rates across different regions and constant changes in regulations, the challenges surrounding VAT can often lead to confusion for company owners. Nonetheless, embracing effective VAT calculation can transition businesses from ambiguity to certainty, eventually enabling them to thrive in the market.

Accurate VAT calculation is not just a matter of legal compliance; it greatly impacts a company's profitability and cash flow. An in-depth understanding of VAT allows businesses to optimize pricing strategies, manage cash reserves, and make strategic financial decisions. Utilizing a reliable VAT calculator can simplify this process, helping companies streamline their operations and concentrate on growth. By acknowledging the significance of precise VAT calculations, businesses can prevent costly mistakes and lay the groundwork for sustainable success.

Comprehending VAT Computation

VAT, generally known as VAT, represents a crucial component of the tax system for firms in various countries. It is a expenditure tax imposed on the value added to goods and offerings at every stage of production or distribution. Businesses must correctly calculate VAT to guarantee adherence with tax rules, steer clear of fines, and preserve their financial health. The complexity of VAT percentages and rules can lead to confusion, thereby making it crucial for companies to grasp how to compute this tax correctly.

Accurate VAT assessment starts with understanding the applicable VAT percentages for different goods and offerings. Various jurisdictions may have different rates, and the categorization of items can impact the percentage applied. Inaccuracies in identifying these rates can cause charging too much customers or collecting less than due VAT, resulting in significant financial consequences. Utilizing a trustworthy VAT tool can simplify this process, allowing companies to instantly determine the correct VAT based on the sale price and the relevant rate.

Additionally, keeping detailed documentation is vital for accurate VAT documentation. Companies need to monitor their revenue, purchases, and any exceptions correctly. Complete records not only aids VAT calculations but also acts as a safeguard in case of audits by taxation authorities. By investing in good accounting methods and resources like VAT calculators, businesses can improve their effectiveness, guarantee adherence, and finally encourage a clear monetary operation.

Benefits of an Effective VAT Calculator

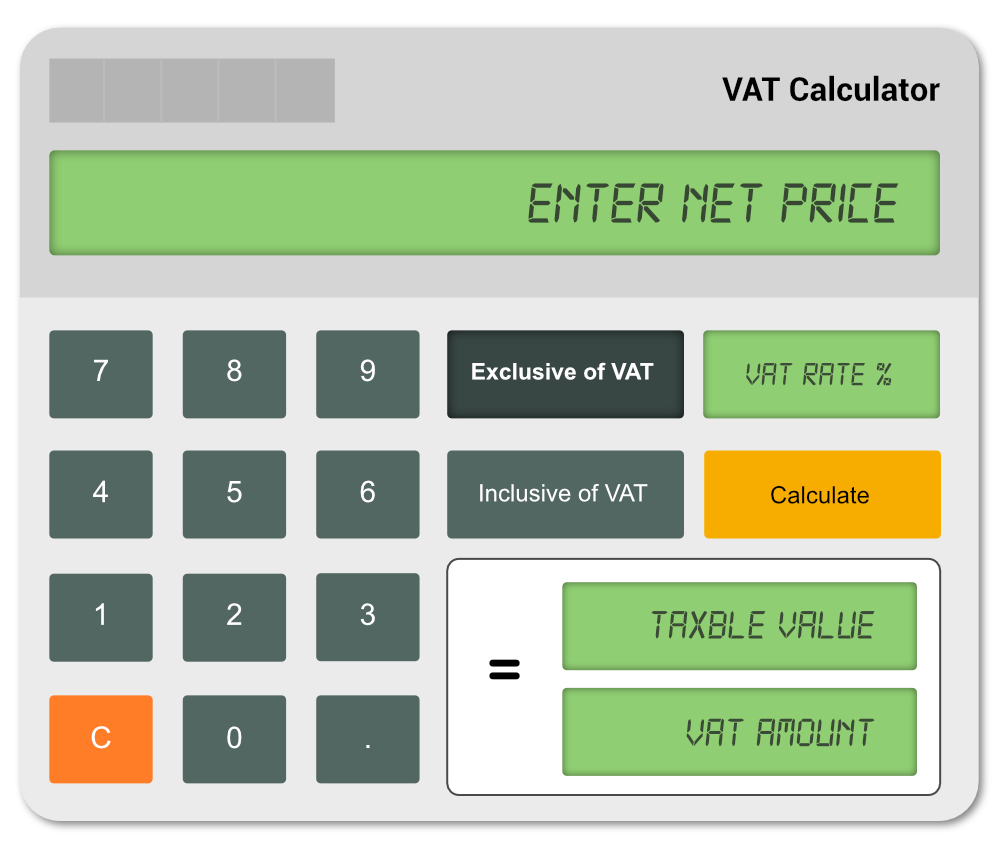

An reliable VAT calculating tool streamlines the process of determining the correct amount of VAT to be applied on products and services. By streamlining computations, companies can greatly minimize the chance of human blunders, which is critical for compliance with tax regulations. Correct calculations help in preventing costly sanctions that may occur from wrong tax reporting. This not only safeguards the financial well-being of the organization but also improves its reputation with tax authorities and customers alike.

Additionally, a reliable VAT calculator enhances organizational efficiency by conserving time that would alternatively be spent on manual calculations. Staff can concentrate on strategic tasks instead of becoming caught up in complex tax information. An effective tool can also handle various VAT rates and offer quick changes as tax laws shift, ensuring that businesses remain compliant even as regulations change. This flexibility can be a considerable benefit for organizations operating in various regions with diverse VAT obligations.

Moreover, using an effective VAT calculator helps companies maintain precise records over time. With accurate VAT calculations, businesses can easily generate reports for audits or financial assessments, providing clarity and oversight over financial data. This structured approach not only assists in financial planning and cash flow management but also builds partner confidence in the business's monetary practices. Ultimately, purchasing a reliable VAT calculator is a wise decision that can lead to sustained savings and more efficient operations.

Implementing Value Added Tax Computational Strategies

Effective Value Added Tax calculation strategies are essential for organizations looking to improve their monetary accuracy and compliance. One of the initial steps in deploying these methods involves integrating a reliable VAT computational tool. This tool can streamline the VAT calculation procedure, reducing the risks of manual error and ensuring that companies consistently apply the correct VAT rates. By utilizing vat calculator ireland , organizations can quickly assess their tax liabilities, facilitating smoother monetary operations.

Training employees on VAT laws and proper application of VAT calculators are also important. Employees should understand how VAT functions, including the nuances of incoming and outgoing tax, along with the various percentages pertaining to various products and offerings. Regular education guarantees that everyone involved is well-equipped to manage VAT computation effectively, which eventually promotes the business’s overall financial health and compliance with taxation laws.

Finally, regular inspections of VAT procedures and the implementation of reporting instruments help ensure precision in VAT calculations. By periodically reviewing VAT calculations and processes, businesses can identify discrepancies and rectify them before they lead to costly mistakes. This preventive strategy not only aids legal compliance but also establishes a reputation for financial honesty, making it an integral component of effective VAT calculation methods.